If one was to see all the development activity going on in Toronto, they would be hard pressed to assume anything other than this city is booming. In fact, there was a recent Toronto Life article about just that. Things, as they often are, are not as they appear.

Toronto has been in a persistent budget crisis for what seem like forever. Every year we are warned that this city is on the verge of a calamity. The cause for this, as least by what we are told, is due to underfunding from upper levels of government. There is some merit to that. But that is not the only reason.

Residential development itself is hastening the city's deteriorating financial health. How can that be you ask? Wouldn't the addition of new tax paying developments help the city out by providing additional revenue? Yes, and more importantly No. Nearly all development in Toronto over the last twenty years has been residential. Residential development does expand the tax base, but it also greatly adds to the city's costs.

If the added costs exceed the added revenue then things will get worse, which is what they are doing. So how do we know if new development adds more expense than it generates in revenue. First off, upfront costs associated with new development is paid for from development fees. These fees cover the costs to expand water, sewer, transportation and other fixed assets needed to service them. The issue at hand is what ongoing services cost and do they scale with density.

A large portion of the Toronto's spending does not scale with density. In fact there is much research that shows large city's are not cheaper, ie. that they do not benefit from economies of scale. Looking at Toronto, new residents increase the need for larger police, fire and EMS departments. Plus more Libraries, parks and recreation, health services etc.

In a report titled "Are Ontario Cities at a Competitive Disadvantage Compared to U.S. Cities?", Toronto's Dr. Enid Slack compiled some data regarding the costs associated with providing municipal services in Toronto. In the year 2000, it reports that the cost to provide Transportation (not public Transportation) , public safety, Sewage, Water Solid Waste, Parks and Rec, Admin, and Libraries at $1,553 per person in Toronto. Per household this would equal approx. $3,800. These are not programs downloaded on the city. These are traditional municipal services. On average the city received $2,200 (not incl. the education portion) in property taxes per household. Seeing that these services are primarily for residents and not greatly consumed by businesses it is obvious that the residential sector is being subsidised.

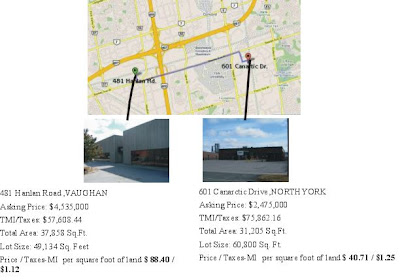

While that is typical, most cities charge higher taxes to business properties than residential, it does create a major caveat. If growth in the residential sector is not matched by equivalent increase in the non residential sector the imbalance will increase. With property taxes already so high on non residential properties, the city has had virtually no growth in this sector. Except for four large projects, all which received a preferential tax rate, they has been nothing to offset the growth in the residential sector. The city is constrained by both reality and policy, in being able to increase non residential taxes, at the same time it is under pressure to keep residential taxes in line with inflation.

Toronto needs to have growth in the portion of the tax base that generates excess revenue. So long as there is an increase in the proportion of the class of properties that consume more than they produce in revenue, Toronto will still be chased by a financial snowball.

http://www.competeprosper.ca/images/uploads/EnidSlackReport_190603.pdf